Why a flexible contract is an ideal choice for an energy market in backwardation…

Many energy consumers first ask, what is Backwardation? First some definitions to help explain why a Flexible contract is a sensible choice when customers expect prices to fall in coming months:

- Spot Price: The spot price is the market price for immediate delivery. i.e. you pay the spot price when buying energy for immediate consumption.

- Future Price: Is an agreed upon price for future delivery of energy. i.e. you pay the futures price when buying energy for future consumption, this could be for tomorrow, or years into the future.

- Price Curve: How prices from current time to future time compare.

- Near Curve: prices close to present time

- Far Curve: prices further into the future

- Purchasing: If you want to purchase energy for consumption today you buy at Spot Price. If you want to purchase energy for consumption tomorrow or later, you buy a Futures Price.

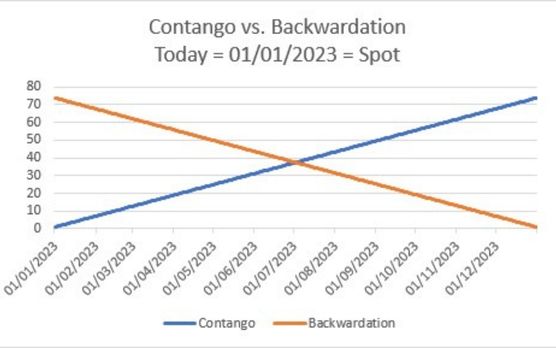

- Contango: If today’s price, aka spot price, is lower than the futures price the market is in Contango. i.e. it costs more to secure energy for a future delivery date than for delivery today. A price chart of a market in contango is up and to the right. Historically UK energy contracts would be in a contango because of factors like storage costs, supply risk, delivery costs, transmission costs, green costs, making longer term contracts more expensive than shorter term contracts.

- Backwardation: If today’s price, aka spot price is higher than futures prices, the market is in Backwardation, i.e. it costs less to secure energy for a future delivery date than for delivery today. A price chart of a market in Backwardation would be down and to the right. Since Russia’s invasion of Ukraine, there has been a spike in supply risk, resulting in UK energy prices in Backwardation, i.e. purchasing energy for a future consumption date is cheaper than purchasing energy for current consumption.

- Price Fluctuations: The futures prices can and will fluctuate over time in response to changing market conditions, and forward curves may change back and forth from Contango to Backwardation depending on the price difference between spot and futures prices.

Prior to the current energy crisis, UK energy contract prices were typically in Contango, i.e. forward prices being more expensive than spot prices. This was easily observed by longer term contracts being more expensive than shorter term contracts. The Russian invasion of Ukraine shook the global energy market, and energy prices went into Backwardation, i.e. spot prices are more expensive than future prices. This is observed by longer term contracts being cheaper than shorter term contracts.

So what is a customer to do when the market is in Backwardation, i.e. when prices are expected to fall?

We all need energy, and failure to secure a contract will result in expensive out of contract rates, so customers are motivated to secure a contract. We have to rule out securing multiple short term contracts as an uneconomical and inefficient strategy. Fortunately, for customers with consumption large enough to qualify, the solution it to opt for a Flexible contract. Most consumers are reluctant to over commit to a long term contract when they think prices are falling. Flexible contracts enable consumers to avoid out of contract rates, and secure tranches of energy as prices soften.

Historically, only the largest of the large consumers could qualify for a flexible contract, so up until very recently this option was out of reach for most of the market. The good news is that Direct Power has the ability to offer a Flexible contract to customers consuming upwards of 400,000kWh. With this Flexible contract, we enable smaller consumers to level the playing field against their larger competitors. Thanks to this Flexible contract, smaller businesses can now access the same contract options as the largest players in the market, which is truly game changing.

In summary, with a market in Backwardation, if you secure a Flexible over a more traditional Fixed price contract you sacrifice budget certainty, but gain in many ways, including:

- Transparent commodity costs, market screen price.

- An effective risk managed strategy, multiple purchases instead of one.

- Flexibility, no longer worry about timing the market, enabling you to ride any downward price curve.

- Freedom from worrying about when your renewal date falls.

- Removal of supplier risk premium from cost stack, major savings on unit rate.

- A hands off adaptable purchasing strategy that evolves with market conditions.

When you opt for a Flexible contract, you want to secure the contract as soon as possible, to give the commodity trader as much time as possible to secure your volume on market dips. If we were to secure the Flexible contract a month ahead of the start date you only give the commodity trader a month’s opportunity to secure a good price. If you secure the Flexible contract a year before the contract start date, you give the trader 12 months’ worth of chances to secure a good price. To explain this better, we can use the analogy of a stock trading account. You want to open the account so you can buy stocks when prices dip. If you wait to open the account until prices dip, chances are you will miss out on the dip, as you wait for the account to be set up.

So the key take away is: When the market is in backwardation, and your consumption qualifies for a flexible contract, you want to secure a flexible contract ASAP, to enable more opportunities to secure your energy on price dips.

Get in touch today… we want to help smaller customers handle this energy crisis with the same tools as the larger players, giving your organisation the competitive edge in a softening energy market!