Electricity, flexible contract, Natural Gas

Reasons why a business would choose a flexible contract instead of a fixed price contract… Choosing between a flexible priced electricity contract and a fixed price contract depends on a business’s specific circumstances, risk tolerance, and market...

Electricity, flexible contract, Natural Gas, peer-to-peer

What is the Peer-to-peer Energy Market? Peer-to-peer energy contracts disrupt the traditional energy market to deliver both energy exporters and energy importers (consumers), great prices. Peer-to-peer (P2P) energy markets are decentralized platforms that allow...

Electricity, flexible contract, Natural Gas

What type of contract is a good fit when prices are expected to fall? Flexible or Multi-Purchase contracts are the perfect contracts to secure when prices are falling. Historically, Flexible of Multi-purchase contracts were reserved for the largest of energy...

Electricity, flexible contract, Natural Gas

What kind of Corona contract do you want? Historically gas and electricity contracts have fallen into three key categories: Fixed, Non-Fixed (aka Pass Through), and Flexible. The key difference being that Fixed contracts offer price certainty, whilst Non-Fixed (aka...

Electricity, flexible contract, Natural Gas

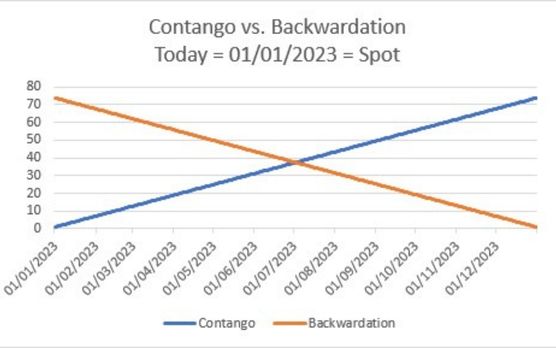

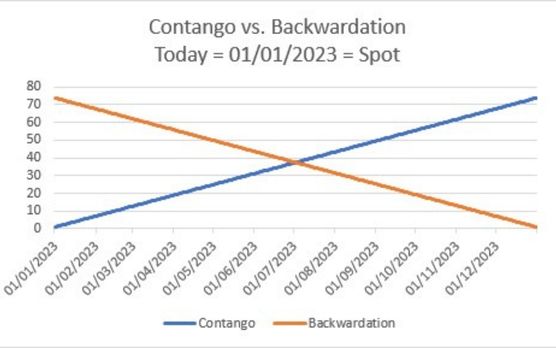

Why a flexible contract is an ideal choice for an energy market in backwardation… Many energy consumers first ask, what is Backwardation? First some definitions to help explain why a Flexible contract is a sensible choice when customers expect prices to fall in...

Electricity, flexible contract, Natural Gas

What do you do when your broker or TPI fails to manage your Flexible Purchasing Agreement for energy, electricity or gas? There are plenty of victims in the current electricity crisis, from the pensioner struggling to pay their heating bill, to the large company that...